Monthly Archives: April 2017

Personal loans are the fastest and the most convenient form of credit today. Fast approval coupled with speedy disbursal and no collateral make it the credit instrument of choice during emergencies. People also have been using these loans for home renovation, financing weddings, education and sometimes even vacations. However, before taking a personal loan, there…

A personal loan is usually an easy answer to your immediate financial needs. It is easily approved and banks generally have a hassle-free process for personal loan application. Having said that, you should be cautious while applying for a personal loan because a single mistake can lead financial troubles and also degrade your credit rating….

Life is uncertain and you rarely know when you might need some extra money to help cover your expenses. That is where a personal loan comes into the picture. Taking a personal loan during such times can help you tide over financially. However, there are a few things to consider before you opt for that…

At IndusInd Bank, we believe that no dream is too extravagant. With minimal documentation, smooth processing and speedy approvals, we have made personal loan procurements seamless and easy. So, whether it’s a house that you have been intending to buy or your children’s impending education or wedding that you have been planning for, IndusInd Bank…

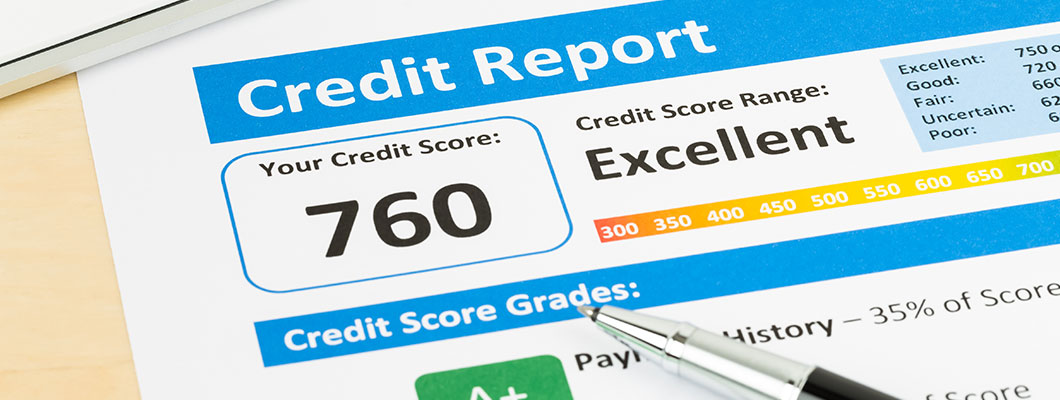

One can’t predict when a sudden need for funds might arise. It is, therefore, advisable to keep your credit record spotless. A bad credit/CIBIL score, arising from late payment or non-payment of credit card bills, can severely hamper your attempt to procure a personal loan. However, having a good CIBIL score will considerably improve your…

Offers

Offers Rates

Rates Debit Card Related

Debit Card Related Credit Card Related

Credit Card Related Manage Mandate(s)

Manage Mandate(s) Get Mini Statement

Get Mini Statement

categories

categories Bloggers

Bloggers Blog collection

Blog collection Press Release

Press Release