Navigating the Benefits of Auto-Renewal Fixed Deposits

Posted on Monday, May 20th, 2024 |

Fixed deposit is one of the most preferred and reliable investment options sought by individuals seeking stability and guaranteed returns. The reason for their popularity is the security and guaranteed returns they offer on the invested amount. Nowadays, the financial market has numerous lucrative products, be it systematic investment plans, unit-linked investments, or traditional fixed…

Read moreLeveraging Savings Accounts for Long-Term Financial Planning

Posted on Monday, May 20th, 2024 |

In today’s fast-paced world, where financial stability is paramount, strategic planning is crucial. One of the fundamental pillars of a robust financial plan is a reliable savings account. It serves as a cornerstone for managing day-to-day expenses, emergency funds, and, most importantly, long-term financial goals. In this blog, we’ll explore the significance of savings accounts…

Read moreSmart Strategies for Maximizing Savings in the New Financial Year

Posted on Monday, May 20th, 2024 |

As we usher in the new financial year, it’s an opportune time to revamp our savings strategies. Whether you’re aiming to build an emergency fund, save for a big purchase, or plan for retirement, optimizing your savings can set you on the path to financial stability and success. Here are some tips to help you…

Read moreBenefits of Digital Banking

Posted on Monday, May 20th, 2024 |

In today’s fast-paced world, digital banking has emerged as a game-changer, revolutionizing the way we manage our finances. Gone are the days of long queues at the bank and tedious paperwork; digital banking offers convenience, efficiency, and a plethora of benefits that cater to our modern lifestyles. Convenience at Your Fingertips One of the most…

Read moreWhat Is a Credit Card Number and How Is It Useful?

Posted on Thursday, May 16th, 2024 |

In today’s digital age, credit cards have become indispensable tools for managing finances, making purchases, and accessing credit. At the heart of every credit card is a unique numerical identifier known as the credit card number. Understanding a credit card number and how it functions can provide valuable insights into the mechanics of financial transactions…

Read moreUnderstanding Interest Rates for Credit Card Cash Withdrawals: A Comprehensive Guide

Posted on Thursday, May 16th, 2024 |

Credit cards offer a convenient means of accessing funds when cash is not readily available. Moreover, one of the lesser-known benefits of using credit cards is also their capability to facilitate cash withdrawals from ATMs. This feature offers a convenient fallback option when you urgently need hard cash, especially when alternative payment methods are unavailable….

Read moreHow To Pay Credit Card Bill Using UPI?

Posted on Thursday, May 16th, 2024 |

In today’s world of digital payments, the Unified Payments Interface (UPI) is easily proving to be one of the most convenient and secure ways to transfer funds instantly. Even credit card payments can now be seamlessly made using UPI. Read on to learn how and why to do this so that you always pay your…

Read moreEssential Credit Card Terminology: Key Terms and Definitions Explained

Posted on Thursday, May 16th, 2024 |

Credit cards have become indispensable in our financial lives. They were the first financial tools people used concurrently with cash, while some users used credit cards only. But before you apply for a credit card, you should understand they are a responsibility. You must also be aware of numerous factors, like the charges associated with…

Read moreFirst-Time Credit Card Applicant: 10 Things to Know Before Applying for Your First Credit Card

Posted on Thursday, May 16th, 2024 |

Being eligible for a credit card is a milestone as it signifies that you have met certain conditions for banks to trust you with credit. To improve your credit score and have a better chance for credit approval, understanding all the minute credit card-related details is essential. Ten Things You Must Know Before You Apply…

Read moreForex Cards vs. Traditional Banking: Which is the Better Option for International Travel

Posted on Thursday, May 16th, 2024 |

Adding ‘international trip planning’ to our busy schedule sends stress soaring! ATMs, credit cards, forex cards – there are one too many finance options with complex rules! However, selecting the right one can make all the difference in ensuring you have a smooth and hassle-free vacation. The two most popular options travellers face are forex…

Read more7 Forex Card Trends: Emerging Innovations Shaping the Future of Travel Money

Posted on Wednesday, May 15th, 2024 |

Planning a trip abroad? You’ll need foreign currency. And while travellers’ checks were once the norm, forex cards are now the preferred way for globetrotters to access travel money. Forex cards allow you to load multiple currencies onto a single card, which you can then use to withdraw cash or make purchases while travelling overseas….

Read moreIs It Good to Take Home Loan to Save Tax in India?

Posted on Wednesday, May 8th, 2024 |

Summary: With features such as flexible tenure and high loan amounts, home loans are ideal for purchasing or constructing a house. Home loans in India also offer borrowers tax savings under the Income Tax Act, 1961. Borrowers can claim tax deductions on the principal repayment, interest repayment, and stamp charges under different sections of the…

Read moreHow Much Home Loan Can You Get Based on Your Salary?

Posted on Tuesday, May 7th, 2024 |

Summary: A home loan is a secure and convenient way to purchase your dream house. To determine your home loan amount, lenders consider your salary and job stability. The amount is also influenced by factors like age, credit score, existing liabilities, and property value. Choose IndusInd Bank for favourable terms to achieve your homeownership dreams…

Read moreIndusInd Bank Platinum RuPay Credit Card: Setting It Apart from the Rest

Posted on Tuesday, April 30th, 2024 |

In the competitive landscape of credit cards, finding the right one that aligns with your lifestyle and financial goals can be a daunting task. However, when it comes to exceptional value, rewards, and benefits, the IndusInd Bank Platinum RuPay Credit Card stands out as a top contender. In this blog, we’ll explore what sets the…

Read moreConvenient Grocery Shopping: Exploring UPI Payment Options with Credit Cards

Posted on Tuesday, April 30th, 2024 |

With the rise of digital payment methods, consumers now have more choices than ever when it comes to making transactions. One such option that has gained popularity is Unified Payments Interface (UPI), which offers a seamless and secure way to pay for goods and services, especially groceries. In this blog, we’ll explore the convenience of…

Read moreA Comprehensive Guide for Gen Z: Maintaining a Stellar Credit Score

Posted on Tuesday, April 30th, 2024 |

Generation Z, born roughly between the mid-1990s and early 2010s, is stepping into adulthood in an era defined by rapid technological advancements and evolving financial landscapes. As this dynamic generation begins to navigate the complexities of financial independence, one crucial aspect to consider is building and maintaining a stellar credit score. In this blog, we’ll…

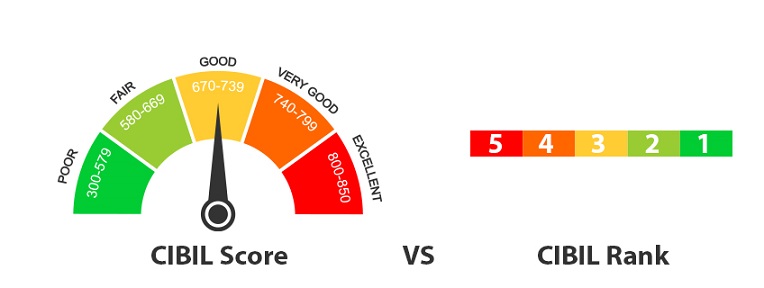

Read moreUnderstanding the Contrast: CIBIL Score and CIBIL Rank

Posted on Tuesday, April 30th, 2024 |

In the world of credit, terms like CIBIL score and CIBIL rank are often used widely amongst the lending industry, leading to confusion among consumers. However, these two metrics serve different purposes and offer unique insights into creditworthiness. In this blog, we’ll explore the contrast between CIBIL score and CIBIL rank, and how understanding these…

Read moreTitle: Decoding the Credit Habits of Millennials: Insights and Strategies

Posted on Tuesday, April 30th, 2024 |

Millennials, often referred to as the generation born between the early 1980s and mid-1990s, have been reshaping the economic landscape with their unique financial behaviors and preferences. From their approach to saving and investing to their attitudes towards credit and debt, millennials’ financial habits are a topic of interest and scrutiny. In this blog, we…

Read moreTitle: Stay Ahead: Shield Your Credit Score the Smart Way

Posted on Tuesday, April 30th, 2024 |

Your credit score is more than just a number; it reflects your financial health and credibility. Whether you’re applying for a loan, renting an apartment, or even getting a new job, your credit score plays a significant role in shaping your financial future. That’s why it’s essential to take proactive steps to safeguard and improve…

Read moreSecuring Your Child’s Future: The Role of Fixed Deposits

Posted on Tuesday, April 30th, 2024 |

Ensuring a bright and secure future for our children is a top priority for parents. While there are numerous avenues to invest in their future, fixed deposits (FDs) emerge as a reliable option offering stability, security, and growth potential. Let’s delve into how FDs can play a pivotal role in securing your child’s future. Financial…

Read more

Offers

Offers Rates

Rates Debit Card Related

Debit Card Related Credit Card Related

Credit Card Related Manage Mandate(s)

Manage Mandate(s) Get Mini Statement

Get Mini Statement

categories

categories Bloggers

Bloggers Blog collection

Blog collection Press Release

Press Release