What is a Bearer Cheque?

Posted on Monday, September 9th, 2024 | By IndusInd Bank

A bearer cheque is a financial instrument payable to anyone who presents it at the bank. Unlike other types of cheques, a bearer cheque does not need the endorsement of the person to whom it is issued. This makes it easy to transfer.

Let’s learn more about the meaning of a bearer cheque and its various aspects.

What are Bearer Cheques?

The below points provide an overview of bearer cheques:

- A bearer cheque is a type of cheque that is payable to the person who holds or presents the cheque at the bank. The meaning of a bearer cheque lies in its name – the bearer of the cheque is entitled to receive the payment.

- It does not need the endorser’s signature, which allows for easy transferability. It makes bearer cheques useful for urgent transactions without extensive verification.

- A bearer cheque is often used to make cash withdrawals or payments where the payee’s identity is not a concern.

- To cash a bearer cheque, the holder must present it to the bank teller. The bank verifies the cheque’s authenticity and checks for discrepancies. There may be no need for identification of the presenter.

- A bearer cheque can be less secure compared to other types if precautions are not taken care of. Therefore, the issuer must trust the person they give the cheque to, as anyone who obtains it can cash it. One should treat a bearer cheque as if it were cash.

Also Read: What is the Cash Deposit Limit in a Savings Account?

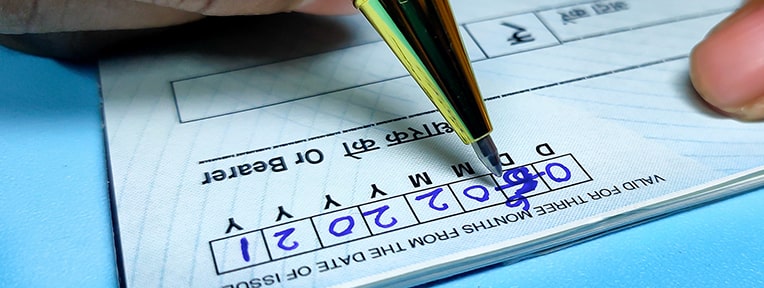

How to Write a Bearer Cheque?

Here’s a step-by-step guide on how to write a bearer cheque:

1. Date: Write the date on the top right corner of the cheque.

2. Payee’s Name: Write ‘Bearer’ or ‘Cash’ in the space provided for the payee’s name. You can also leave it blank or write the name of the person and add “or bearer”.

3. Amount in Words and Figures: Write the amount to be paid in words and figures.

4. Signature: Sign the cheque at the bottom right.

Now that you know what a bearer cheque is and how to write one, let’s see what features and benefits it offers.

Features and Benefits of Bearer Cheques

These cheques come with several features and benefits, such as:

1. Ease of Transfer

The primary feature of a bearer cheque is its ease of transferability. Anyone who holds the cheque can present it at the bank for payment without further endorsement.

2. Quick Settlement

Bearer cheques ensure quick settlements. This makes them ideal for transactions that need immediate cash payments.

3. No Identification Required

The bank does not need to verify the identity of the person presenting the cheque. This simplifies the transaction process even further.

4. Many uses

A bearer cheque can be used for various purposes. This can include cash withdrawals, payment of dues, or the transfer of funds, without the need for the payee to visit the bank.

Some people may wonder whether a bearer cheque is the same as an order check. One must remember that an order cheque requires the payee’s endorsement. It is payable to that specific person named on the cheque. Bearer cheques need no such instructions.

Conclusion

Bearer cheques are a convenient financial instrument for quick transactions. But these cheques carry risks if lost or stolen, as anyone who holds the cheque can cash it. However, its benefits often outweigh the risks it offers. One must always consider the security aspects and use bearer cheques with care.

For secure and efficient banking, consider opening a Savings Account online with IndusInd Bank. The account opening process is instant, entirely digital and 100% paperless! With a bank account from IndusInd Bank, you can enjoy seamless digital banking services, competitive interest rates, cashback, and complimentary offers, and more.

Open a Savings Account with IndusInd Bank today and enjoy a range of benefits tailored to your financial needs!

Disclaimer: The information provided in this article is generic and for informational purposes only. It is not a substitute for specific advice in your circumstances. Hence, you are advised to consult your financial advisor before making any financial decision. IndusInd Bank Limited (IBL) does not influence the views of the author in any way. IBL and the author shall not be responsible for any direct/indirect loss or liability incurred by the reader for making any financial decisions based on the contents and information.

Offers

Offers Rates

Rates Debit Card Related

Debit Card Related Credit Card Related

Credit Card Related Manage Mandate(s)

Manage Mandate(s) Get Mini Statement

Get Mini Statement

categories

categories Bloggers

Bloggers Blog collection

Blog collection Press Release

Press Release