Notes:

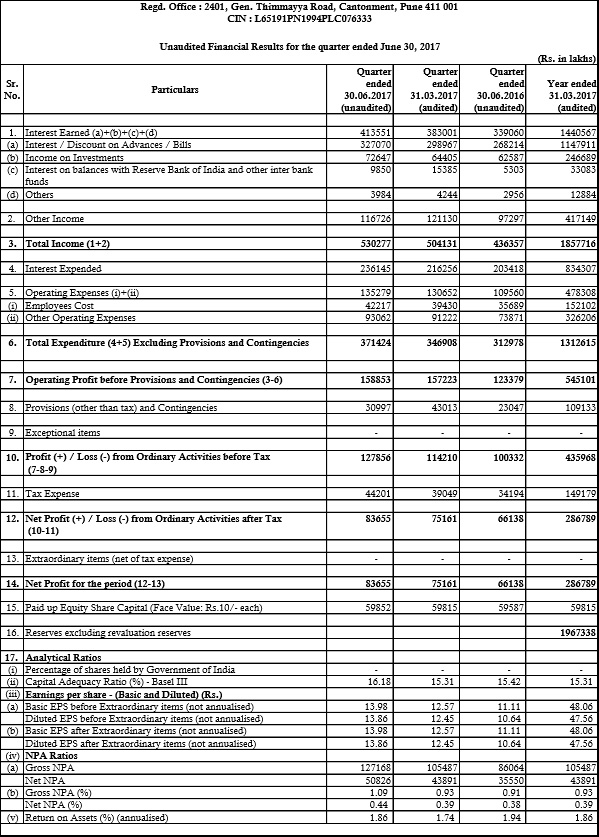

- There has been no material change in the accounting policies adopted during the quarter ended June 30, 2017 as compared to those followed for the year ended March 31, 2017.

- The working results for the quarter ended June 30, 2017 have been arrived at after considering provision for standard assets, including requirements for exposures to entities with Unhedged Foreign Currency Exposure, non-performing assets (NPAs), depreciation on investments, income-tax and other usual and necessary provisions.

- The above financial results for the quarter ended June 30, 2017 were subjected to a Limited Review by the Statutory Auditors of the Bank. A clean report has been issued by them thereon. These financial results were reviewed by the Audit Committee and subsequently have been taken on record and approved by the Board of Directors at its meeting held on July 11, 2017

- RBI Master Circular DBR.No.BP.BC.1/21.06.201/2015-16 dated July 01, 2015, as amended, on Basel III Capital Regulations contain guidelines on certain Pillar 3 and leverage ratio disclosure requirements that are to be made along with the publication of financial results. Accordingly, such applicable disclosures have been placed on the website of the Bank which can be accessed at the following link: https://www.indusind.com/content/home/important-links/regulatory-disclosures-section.html These disclosures have not been subjected to the limited review.

- The Capital Adequacy Ratio is computed on the basis of RBI guidelines applicable on the relevant reporting dates and the ratio for the corresponding previous period is not adjusted to consider the impact of subsequent changes if any, in the guidelines.

- In line with the Policy approved by the Board of Directors, the Bank has transferred an amount of Rs.70 crores towards floating provision for advances during the quarter ended June 30, 2017. The floating provision has been considered while computing the Net NPAs and Provision Coverage Ratio (PCR).

- Pursuant to RBI circular FMRD.DIRD. 10/14.03.002/2015-16 dated May 19, 2016, the Bank has, with effect from October 3, 2016, considered its repo / reverse repo transactions under Liquidity Adjustment Facility (LAF) and Marginal Standing Facility (MSF) of RBI as Borrowings / Lending, as the case may be. Consequently, interest expended on repo borrowings with RBI is included under ‘Interest Expended’ and interest earned on reverse repo with RBI is included under ‘Interest Earned-Interest on Balances with Reserve Bank of India and other inter-bank funds’. Hitherto, the repo / reverse repo transactions were included under ‘Investments’ and interest thereon was included under ‘Interest Earned – Income on Investments’. Figures for the previous periods have been regrouped / reclassified to confirm to current period’s classification. The above regrouping / reclassification has no impact on the profit of the Bank for the quarter ended June 30, 2017 or the previous periods.

- On March 14, 2017, the Bank made an announcement of entering into an agreement with Infrastructure Leasing and Financial Services Ltd., (IL&FS) the Promoter Shareholders of IL&FS Securities Services Ltd., (ISSL) to acquire 100% of ISSL. The proposed transaction is conditional on definitive agreements and approvals including regulatory approvals, and as such, does not have any bearing on the current financial results or the financial position of the Bank as at June 30, 2017.

- During the quarter ended June 30, 2017, the Bank allotted 3,68,606 shares pursuant to the exercise of stock options by certain employees.

- Previous period / year figures have been regrouped / reclassified, where necessary to conform to current period / year classification.

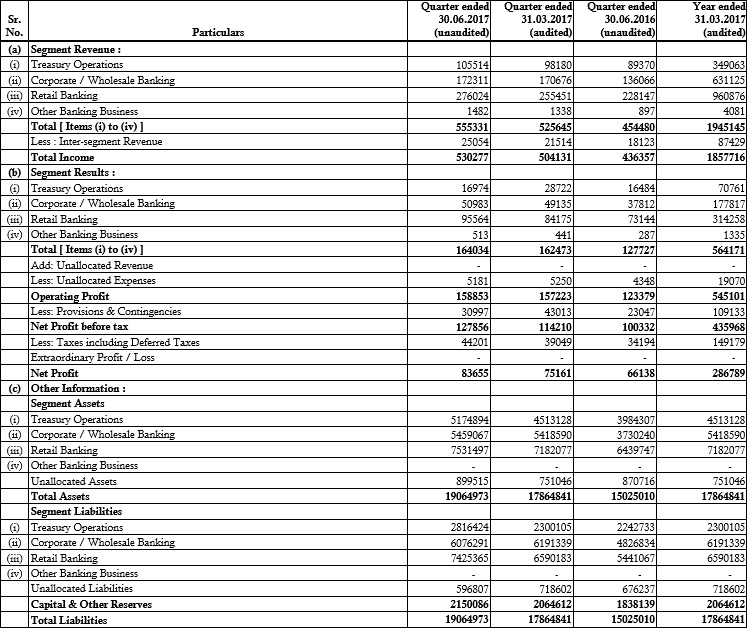

Notes:

Pursuant to RBI circular FMRD.DIRD. 10/14.03.002/2015-16 dated May 19, 2016, the Bank has, with effect from October 3, 2016, considered its repo / reverse repo transactions under Liquidity Adjustment Facility (LAF) and Marginal Standing Facility( MSF) of RBI as Borrowings / Lending, as the case may be. Consequently, interest expended on repo borrowings with RBI is included under ‘Interest Expended’ and interest earned on reverse repo with RBI is included under ‘Interest Earned-Interest on Balances with Reserve Bank of India and other inter-bank funds’. Hitherto, the repo / reverse repo transactions were included under ‘Investments’ and interest thereon was included under ‘Interest Earned – Income on Investments’. Figures for the previous periods have been regrouped / reclassified to conform to current period’s classification. The above regrouping / reclassification has no impact on the profit of the Bank for the quarter ended June 30, 2017 or the previous periods

Offers

Offers Rates

Rates Debit Card Related

Debit Card Related Credit Card Related

Credit Card Related Manage Mandate(s)

Manage Mandate(s) Get Mini Statement

Get Mini Statement

categories

categories Bloggers

Bloggers Blog collection

Blog collection Press Release

Press Release